Harnessing AI in Banking and Managing the Risk for Disintermediation

McKinsey's Blueprint for AI-first banking institutions

The banking industry stands at a critical juncture as artificial intelligence (AI) reshapes financial services. This article explores the transformative potential of AI in banking and the urgent need for traditional banks to adapt or risk disintermediation. By examining recent market developments, such as ServiceTitan's successful IPO, and drawing from insights from McKinsey's "Extracting value from AI in banking: Rewiring the enterprise" research, we present considerations for banks to become AI-first institutions. This strategic shift is not just about technological adoption but a fundamental reimagining of banking operations, customer experiences, and business models.

ServiceTitan IPO: The latest example of accelerated disintermediation for banks

ServiceTitan had a highly successful IPO this week. Its stock price increased from $71 to $101 on its first day of trading, valuing the company at $9B or 13x revenue. ServiceTitan positions itself as the operating system that powers the trade. However, one essential component of that operating system is FinTech.

ServiceTitan processed $62B of Gross Transaction Volume in 2024. FinTech accounts for about 25% of ServiceTitan revenue or $193M in 2024. Looking more closely, at ServiceTitan's strategy, FinTech products are at the core of that strategy as it plans to further invest in business and customer financial products.

Companies like ServiceTitan are disintermediating banks as they become the face of banking products to their industry specific customers. Advances in AI technology will only accelerate that trend as AI-native companies drink the incumbents’ milkshake.

Source: https://www.mckinsey.com/mgi/our-research/the-next-big-arenas-of-competition

Banking products are ideally suited to the milkshake strategy. If you are in banking, how do you counter that threat? There is only one way, you must disrupt yourself. McKinsey's article shows areas of opportunities for self-disruption.

Delivering on the Promise of AI in Banking

Many banks are still in the experimental phase of AI adoption. Over 75% of financial services workers are not leveraging any AI technology at work, and more that 85% of financial firms are planning to spend less than 10% of their technology budget on AI technology.

To truly benefit from AI, banking institutions need to integrate AI technologies across all functions. This involves reimagining customer experiences, modernizing core technology, and establishing a platform operating model that aligns talent, culture, and organizational design.

What Does it Mean to be an AI-First Bank?

AI-first banks view AI not just as a tool for cost efficiency but as a means to enhance revenue and improve customer and employee experiences. Successful AI transformation requires:

A focus on business value, emphasizing entire domains rather than narrow use cases.

The integration of AI-powered multi-agent systems into banking operations.

Rooting the Transformation in Business Value

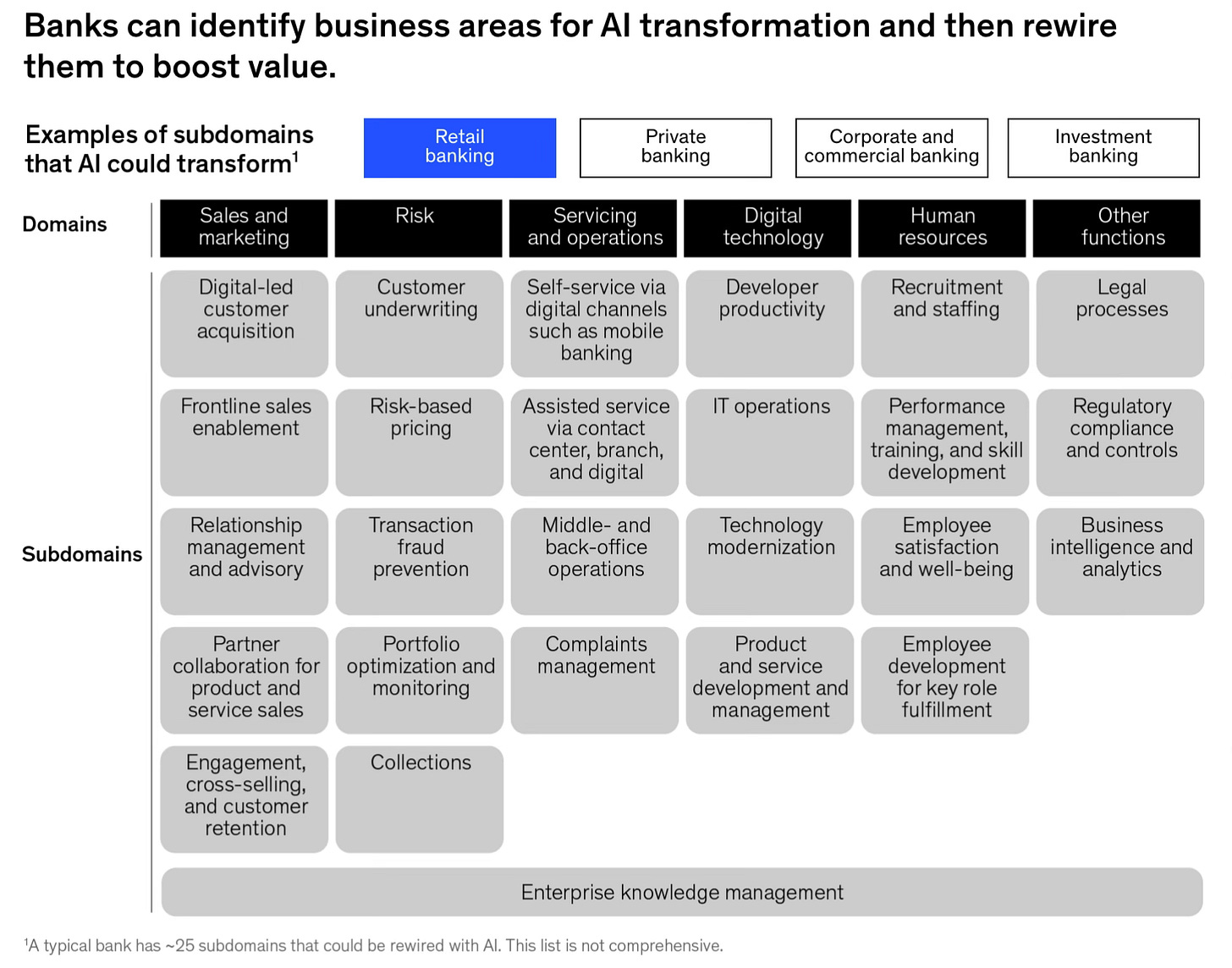

Banks should focus on transforming entire domains and subdomains rather than isolated projects. This involves selecting subdomains with high business impact and technical feasibility for AI transformation. For instance, transforming customer underwriting can involve using generative AI, traditional analytics, and digital tools to reimagine workflows.

An area like underwriting is prime for AI centric innovation from document intake / collection to assessment to contract generation.

Enabling Value Through an AI-Powered Multi-agent Systems

As shown earlier, banks can implement a comprehensive capability stack comprising four layers: engagement, decision-making, data and core tech, and operating model. This stack enables seamless integration of AI across the enterprise. Multi-agent systems provide a major advancement opportunities in decision-making capabilities, capable of automating complex workflows and enhancing productivity.

Banks need to disrupt their own operations, and implement AI solutions as wedges that surround their incumbent systems by capturing data at the point of creation in ways that were impossible before, making it usable, and driving automation around that data.

Banks also need to make sure to establish guardrails around their AI innovation. According to Forrester, 75% of in-house AI agent platforms are likely to fail.

Iterative Approach to Scaling Value from AI

An iterative approach to AI solutions is essential for balancing immediate financial impact with long-term capability building. Initiatives prioritization and building reusable components that can scale to other domains are also essential to a successful strategy for scaling AI solutions.

In large organizations, most of the success of transformation programs hinders on alignment (strategic, incentive, etc.). Establishing cross-functional teams with aligned incentives is crucial to sustained success.

In conclusion, banks must embrace an AI-first approach to avoid the risk for further disintermediation, focusing on holistic transformation rather than isolated projects. By prioritizing high-impact subdomains and fostering cross-functional collaboration, they can harness AI's full potential to enhance customer experiences, drive operational efficiency, and maintain relevance in the marketplace.