The State of Generative AI: A Menlo Ventures Perspective

Explosive growth in Enterprise AI

Menlo Ventures provides a great article on the State of Generative AI in the Enterprise. Below is a summary of the key takeaways, created with the help of Perplexity.

Enterprise AI Adoption

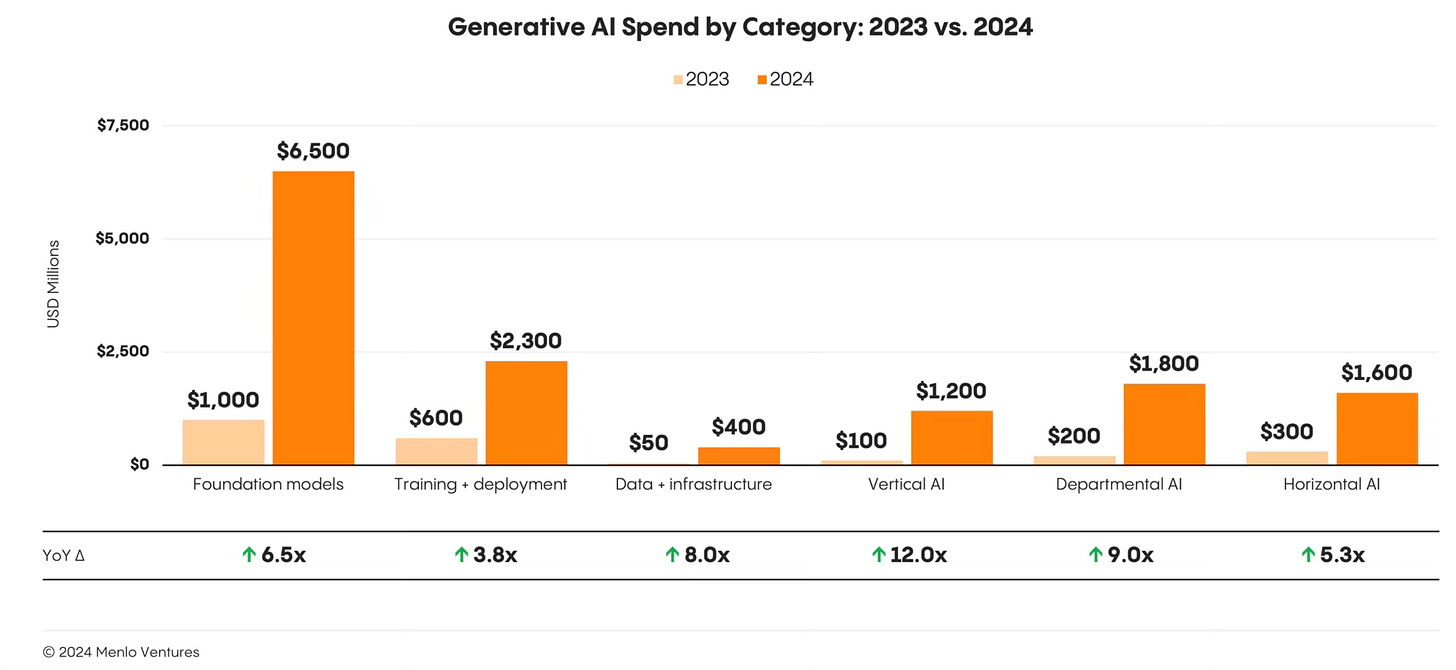

Generative AI spending surged to $13.8 billion in 2024, a 6x increase from 2023. Vertical and Departmental AI respectively saw a 12x and 9x increase in spending. This significant growth signals a shift from experimentation to execution, with 72% of decision-makers anticipating broader adoption of generative AI tools in the near future.

Application Layer Growth

The application layer experienced substantial growth, with enterprises investing $4.6 billion in generative AI applications in 2024, an 8x increase from the previous year. Organizations have identified an average of 10 potential use cases for this technology.

Top Use Cases

Code copilots (51% adoption)

Support chatbots (31% adoption)

Enterprise search and retrieval (28% adoption)

Data extraction and transformation (27% adoption)

Meeting summarization (24% adoption)

Departmental Applications

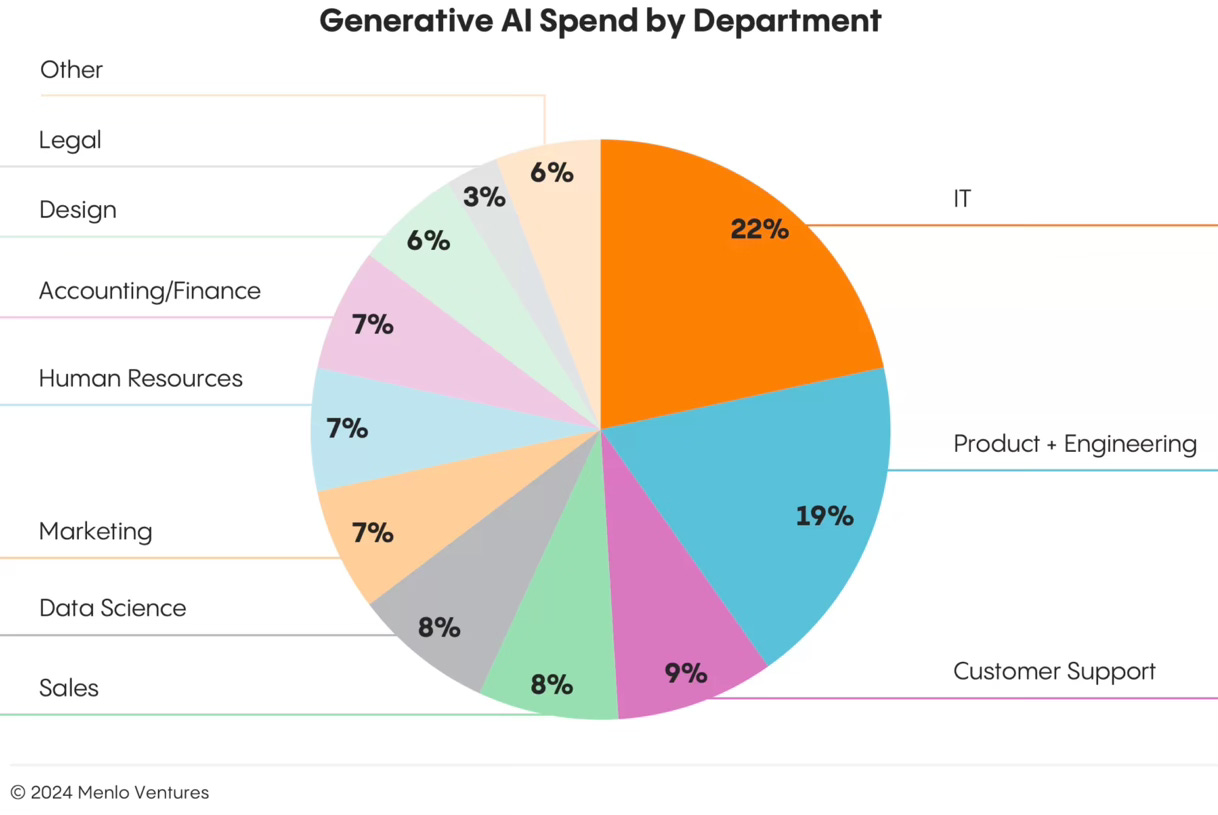

Generative AI adoption is notable for its broad scope across departments.

Technical departments (IT, Product & Engineering, Data Science) dominate AI spending with over half of the spend or 55%

IT: 22%

Product + Engineering: 19%

Data Science: 8%

Design: 6%

Customer-facing functions also receive significant AI budget allocations:

Support: 9%

Sales: 8%

Marketing: 7%

Back-office teams are investing in AI as well:

HR: 7%

Finance: 7%

Legal: 3%

Vertical AI Applications

Vertical-specific AI applications gained traction, particularly in:

Healthcare with $500 million in enterprise spend leads generative AI adoption.

Historically resistant to new technology, the legal industry with $350 million in enterprise spend is embracing generative AI.

Financial services with $100 million in enterprise spend is primed to AI transformation with clear use cases in accounting and financial research.

Media and entertainment with $100 million in enterprise spend is primed for disruption and for pushing of AI generative digital content.

Infrastructure and AI Stack

The LLM layer commands $6.5 billion of enterprise investment. Multi-model strategies are prevalent, with organizations typically deploying three or more foundation models in their AI stacks. LLM market share breaks down as follow:

Closed-source solutions: 81% market share

Open-source alternatives: 19% market share

OpenAI's enterprise market share dropped from 50% to 34%

Anthropic doubled its enterprise presence from 12% to 24%

Design Patterns

RAG (retrieval-augmented generation) dominates with 51% adoption

Fine-tuning remains rare, with only 9% of production models being fine-tuned

The year’s biggest breakthrough? Agentic architectures emerged, powering 12% of implementations

Menlo's Predictions

Agents will drive the next wave of transformation

More incumbents will face disruption from AI-native challengers

The AI talent drought will intensify, leading to increased competition and salary premiums