Key Insights from the 2024 SaaS Benchmarks Report by High Alpha

Are we seeing early signs of upcoming challenges to the traditional SaaS business model?

The 2024 SaaS Benchmarks Report by High Alpha offers a comprehensive analysis of the current state of the SaaS industry, highlighting key trends, metrics, and insights. The report emphasizes the rise of "Generation AI," marking a significant shift in how SaaS companies integrate artificial intelligence into their offerings. This year’s survey data shows AI-native companies are growing more efficiently than past early stage companies. Below are key insights from the report.

Market Stabilization

Emerging Signs of Stabilization: Public SaaS companies have shown signs of stabilization in growth and retention rates after a period of volatility. Net revenue retention has steadied around 110%, with year-over-year revenue growth rates maintaining at 17%-18% over recent quarters.

Venture Capital Activity: Venture capital investment remains steady but fragile, with significant funding directed towards AI-focused companies. However, liquidity challenges persist, impacting funding dynamics as deal value is down 60% from their 2021 pick.

B2B SaaS growth Rates Dropped by over 2/3: Over the last 8 quarters, B2B SaaS growth rates have dropped by over 2/3 from average of 40% during the 2019-2022 period to an average of 11% during the 2023-2024 period.

Growth & Efficiency

AI-Native & Vertical SaaS Outperformance: This was also highlighted in the State of Generative AI by Menlo Ventures. AI-native and vertical SaaS companies are outperforming horizontal SaaS counterparts, particularly in revenue bands above $1M ARR. AI-Native SaaS growth rate is almost 2x the horizontal SaaS growth rate (50% vs 28%)

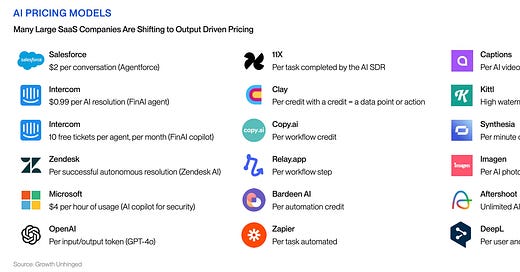

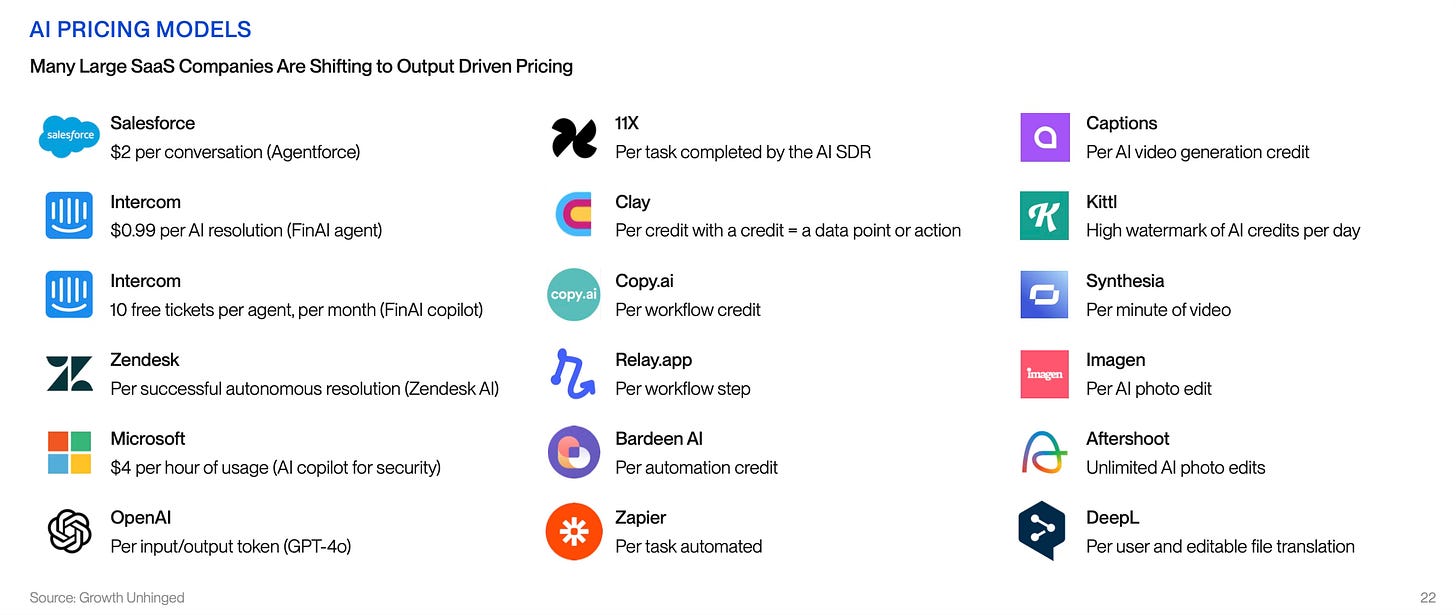

AI monetization is evolving and poses a threat to traditional SaaS monetization: AI pricing is shifting to output driven pricing which is a significant shift on how SaaS is priced.

, wrote an excellent piece on the transition from selling access to selling work.

ARR per Employee: Not surprisingly, as companies grow, ARR per employee increases significantly. The public SaaS median ARR per employee was up 15%. Also, early-stage companies have improved efficiency by managing resources more effectively with the ARR per employee up 3.5x for companies with less that $1M in ARR.

Cash Burn and Rule of 40: Companies remain cautious with cash burn. The Rule of 40 remains a critical metric for evaluating company efficiency and growth balance with the median around 22. Companies with a score between 40 and 60 have a median next twelve months (NTM) revenue multiple of 11.2x.

SaaS Metrics & Trends

Revenue Retention: Gross revenue retention has improved year-over-year, while net revenue retention remains a key growth driver as companies scale. Companies ranging $5-50M in ARR see median GRR around 90%, companies with higher than $50M in ARR have seen a decline in median GRR from 89% to 83%. Median net revenue retention remains in the tight range between 100-105%.

SaaS spend bounced back in 2024: SaaS buyers have re-emerged, increasing SaaS spend by 9% across all company sizes.

Attached paid services to subscription is mainstream: 63% of SaaS companies attach some level of paid services to their subscriptions. Nearly a third of companies buying services have subscriptions of less than $25K.

Gross Margin: Gross margins stay consistent across ARR bands with a median around 80%

People

Workforce Trends: Departmental distribution remains consistent, with early-stage companies increasingly utilizing fractional support, finance being the most popular function supported by fractional executives. Diversity continues to be a challenge. Women in leadership did not change materially from 2023 and hover between 20-25%. People of color representation in leadership role is worse. The High Alpha median for companies $0-50M is an appalling 0%.

Work Culture: Companies with in-office cultures are growing more quickly than companies that are predominately or fully remote but mostly influenced by larger companies increasingly mandating return to office policies.

Founder Wellness

Health Priorities: A majority of founders prioritize exercise and sleep. Yet, founders of the fastest growing companies, not surprisingly, find less time for fitness and get less sleep.

Stress Factors: As growth rates increase, so does founder stress. Over half of the surveyed founders invest in mental fitness to manage these pressures in the form of business coaches (23%), mentors (26%) and mental health specialists (16%). Go-to-market is the area of most concern to founders and executive teams.

Conclusion

Companies that embrace their position in Generation AI are leaning into the enabling technology and ushering in a new generation of products and business models. We are entering a golden age of AI-enabled SaaS companies that will likely re-invent the way software is built, sold, and delivered for years to come.